Tulade.Business.blog – Retirees who are well-read will be familiar with the terms “Safety First” and “sustainable withdrawal rates (SWR).” The term “Safety First” refers to a retirement-spending strategy in which retirees first cover their essential retirement spending needs with assets that have no stock market risk before investing in a risky portfolio. SWR, also known as “the probabilist school,” is a strategy for funding both essential and non-essential retirement spending that is primarily based on stock market returns. The 4% Rule is a probabilistic approach.

The Safety First school is based on long-standing Life-Cycle Economics theory, which can be traced back to the early 1950s work of Franco Modigliani and his student, Richard Brumberg. Zvi Bodie, Jonathan Treussard, and Paul Willen wrote a discussion paper for the Boston Federal Reserve called “The Theory of Life-Cycle Saving and Investing” that is far more comprehensible than the relevant economics literature. Nonetheless, many of us dropped out of ECON 101 the first time the speaker spoke the words “marginal propensity to spend,” so I’m sure there are many of us who might need some more support.

The authors identify three principles for applying the life-cycle theory to financial planning.

- Principle one tells us to focus not on the financial plan itself but “on the consumption profile that it implies.” Consumption equals income less savings during our working years and withdrawals from savings less health expenses in retirement.

- Principle two says to view our financial assets as vehicles for moving consumption from one location in the life cycle to another. We can move consumption from our high-earning years to retirement by saving.

- Principle three says a dollar is more valuable to an investor when consumption is low. A dollar of income is more valuable to us when we are unemployed, for example, than when we have a high-paying job.

Why should you be concerned about life-cycle economics? It is a retirement finance theoretical model and decision-making framework that may serve as a guidance for addressing our retirement finance questions. Modigliani’s discovery that individuals make spending decisions depending on both how much money they have today and how much wealth they hope to have in the future is the foundation of life-cycle economics. In other words, people want a stable level of living throughout their lives.

When a young worker invests a portion of her earnings in a retirement plan, she is choosing that she may require part of the cash she could otherwise spend soon after retirement. Her actions are compatible with life-cycle economics in that she is considering not just her current spending requirements, but also postponing part of that expenditure to her retirement years, when she may require it more.

Life-cycle economics may help with far more than just retirement planning. It can help us determine how much to save, whether to acquire insurance, or how to finance the purchase of a property. The answer to each question may alter based on where we are in the life-cycle. It will give a different response to the issue of how much to save for a household in early adulthood, middle age, and late working years, for example.

We now have the foundation for life-cycle financing. It’s a set of rules, a “framework,” for making financial decisions based on our stage of the human life cycle, present financial circumstances, future financial aspirations, and, most crucially, science. According to life-cycle economics, our objective should be to maximize our enjoyment (utility) of consumption (spending) across our lives. This is a very different aim from the SWR strategy’s recommendation of maximizing overall portfolio returns.

We allocate our current wealth such that our standard of living will be consistent throughout our lifetimes in good times and bad. This provides a framework for making retirement finance decisions. As Bodie, Treussard and Willen state in their discussion paper,”The theory teaches us to view financial assets as vehicles for transferring resources across different times and outcomes over the life cycle.”

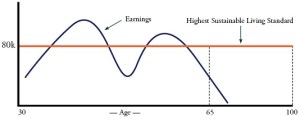

The following graph from Laurence Kotlikoff’s esplanner.com website explains this process. The red line is the household’s lifetime maximum sustainable living standard (consumption). The blue curve is lifetime earnings by age.

When earnings exceed the desired standard of living (the blue line is higher than the red), the household saves for future times when earnings may decline (blue line falls below the red). We smooth the peaks into the valleys until we find the highest “sustainable” amount we can spend (Kotlikoff’s MaxiFi product makes this complex decision for you.[2])

We allocate our current wealth such that our standard of living will be consistent throughout our lifetimes in good times and bad. This provides a framework for making retirement finance decisions. As Bodie, Treussard and Willen state in their discussion paper,”The theory teaches us to view financial assets as vehicles for transferring resources across different times and outcomes over the life cycle.”

Tinggalkan komentar